2022 March 31st, I hosted the Investor Chat with David Peterson, Partner at Angular Ventures to share his experience as an entrepreneur and also as an investor.

Angular Ventures is specialist in early-stage enterprise tech VC firm based in London and Tel Aviv, Angular Venture backs companies born in Europe or Israel with the ambition to define a category and achieve global leadership, usually by starting with the US market. They can invest as early as pre-revenue, pre-product, or at inception, but also lead large seed rounds in more mature companies. The earlier Angular engage with a company, the more they can help founders accelerate their trajectory.

David Peterson joined Angular Ventures, a specialist first-check venture capital firm in October 2021.

Prior to Angular, David worked at Airtable, and took the company from zero to 200,000 customers and a valuation of $5.77 billion. Leading growth and partnerships - developing full-stack GTM strategies for Airtable’s many use cases and building relationships with product, channel and startup ecosystem partners. He previously spent time as a seed stage investor at Founder Collective and bootstrapped Steward, a scalable on-demand consulting business.

David owns an impressive background with a Bachelor of Arts degree magna cum laude in Government and History from Dartmouth College and an MBA from MIT Sloan School of Management.

The panellists in the discussion include:

- Karolina Liljeroth-Dorozynska, venture advisor at Skåne Startups

- Martin Backlund, business developer at Invest in Skåne, Jonatan Tops, program director from Connect Sverige Region Syd

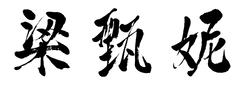

- Zhenni Liang, managing director of Skåne Startups.

During the roundtable discussion, the following 5 startups have joined to pitch:

- Will Gray developed a knowledge base platform called Knologram AB that can transform the growth of MedTech companies.

- Melanie Aronson: has the mission of build, growing and maintaining a community in a fun, simple and effective way with Panion, the future of community building.

- Tatiana Amaya Vanegas: has created a Smart Receipt customer engagement solution. The ClowID, provides individual data for personalised marketing tools while protecting customers' personal information.

- David White: envisioning a true B2B omnichannel by merging the digital and physical channels, David created Lumentric - a SaaS company providing disruptive revenue-generating services for B2B companies.

- Nancy Adrenberg: founder of Allihop AB, a green business travel booking platform. Allihop provides a tool so employees can make informed travel decisions aligned with the corporate sustainability goals.

Watch the event recoding here

About David Peterson

Q: You're the general partner at Angular Ventures, a specialist first check venture capital firm investing in founders redefining the global market. But before we dive into talking about Angular VC, and investment in general, we'd love to learn more about you. So can you tell us a little bit about your background?

I'm one of the partners at Angular, a two partner firm. It's just me and my partner, Gil. It's funny because I'm somewhat new to the world of investing. I really think of myself more as an early stage guy and entrepreneur. So I still wear the investor hat somewhat uncomfortably. Still, that's not how I like to describe myself.

So my career has mainly been as somebody working at early-stage companies, in the first 10 or 15 employees, or building my own business as well. I know we'll get into some of that. So I won't bore you with those details now.

I'll just also say kind of personally, so you guys can get to know me as more than just my LinkedIn profile. I'm an American based in London. I actually moved here in January of 2020. So if you do the math, that was like eight weeks before London lockdown, just a very strange time to move to a new city, let alone a new country. But I moved here with my work at Airtable and moved here with my wife, and we totally fell in love with the city. So, super happy to continue to be here.

And I grew up in the States, in upstate New York, kind of in the middle of nowhere, and have worked in New York City, Boston and San Francisco. So it's like a little bit more personal colour about me.

Q: I would like to hear a little bit more about the early your career. I mean, you were doing a variety of different roles, like how many are the Google investors associated with VC fund. And you also start your own business. So what are some of the key learnings from those experiences?

My first job was actually at Google, where I worked on the ad side of the business. And I had no idea about how any of this stuff worked, like internet businesses, so it was actually incredibly useful. I say that because you know, my undergrad degrees were in history and government. I thought I was gonna go into academia, I spent most of my time reading books, that was kind of like my experience in university.

So working at Google was an amazing experience because it taught me the way that internet businesses actually run, and it gave me a great appreciation for two things that I think are incredibly important and seriously undervalued, which are sales: no matter what your job is, the more senior you get, the more your job is just a sales job; growth marketing, having super analytical approach to marketing. So those were like great early lessons from Google.

But I kind of realised pretty quickly that I didn't work want to work at a massive company. A small, early-stage and messy company really fit my personality better. So, I ended up joining this company called Compstak, which is based in New York City. It's a commercial real estate data platform. You could almost think of it as a B2B marketplace but for commercial real estate data.

I lead growth and expansion there for a little over three years, we expanded from one city to cover the entire United States. And then we sold that underlying data set that we built as an analytics platform to hedge funds.

That was an amazing experience which made me realise how much I enjoyed the early-stage side of things. This is definitely where I want to focus on for the rest of my career. This is what gets me out of bed in the morning.

After that, and I bootstrapped a company my own, which was a hard experience. But for a lot of businesses out there it's the right way to do it. Venture doesn't always make sense, it's very expensive money. So you should only take venture if it really makes sense for your business.

And then, I did a little bit of venture investing at a firm in the States called Founder Collective, which was a seed-stage fund based in Cambridge, Mass and New York. I realised that I was not ready to do investment. I wanted to go back into building stuff. And I had long been obsessed with Airtable as a product. So I was able to kind of weasel my way in and convince the CEO that I could be useful there.

Q: And this is super interesting because you joined Airtable in 2017 as the number 16 employee, and your role was growth in the partnership. Can you tell us a little bit about what that staff role means and what were your main responsibilities?

I'll be honest, the job at the beginning was incredibly vague. My title was basically just the word growth. It was like as vague as it comes. And the role was kind of invented. It was invented to take some things off the plate of the CEO and help think through some of the central growth challenges that we were facing as a company.

For some context, Airtable used to have a fair number of free users who were using the product every day and seemed to be getting a tonne of value out of it, but it was pre-revenue. We had not monetized anything yet. And another big challenge that we faced at Airtable, it's such a horizontal product, it can be your kind of build it into anything. It's a box of Legos that you put together. So another big challenge we faced is we didn't know what the core use cases for the product were going to be.

So, when I joined, the dual existential questions were: okay, eventually we're going to turn it on revenue. Are people going to pay us, will people upgrade? And what are the use cases for this product? People were using the product every day and they were inviting their friends to it or inviting their colleagues to it. But there was no system to go to the market machine. We couldn't say these are the top three user cases to be able to acquire more users, we didn't have that. That was the big thing we wanted to figure out. That ended up being my job, basically trying to figure those two things out.

That's really what I was focused on for the first two years I was at the company. And then after that I built the first growth team to work on those problems. And that team dissolved naturally after a year and a half, two years, and split to become the product marketing team and the growth marketing team because it turns out those were the things we were doing, but we just didn't have those teams. We were kind of doing them all.

So we grew up to be a big enough company that it made sense to split those all walks into separate teams. And then I continued on and scaled up partnership. So that's like a really high level of what I was working on, but happy to go into detail on any of it.

Q: 13:50 from Malenie until answer of 18:00

About Angular Ventures

Q: I would love to know a little bit more about Angular Ventures. Angular is relatively new funds. Your team close the first seed founder $41 million back in 2019. And that took nearly four years. At the most recently, last year, October, your team closed another founder of $80 million. And then you joined the team master GP so huge congratulations. But can you tell us a little bit more about the angular ventures and what's also made you decide to join them?

So, all the credit for everything you just said goes to my partner, Gil Dibner. He's the one who raised the first fund himself back in 2014 to 2018. So I've heard the stories about how challenging that was and the amazing amount of grit and perseverance he brought to that, but I was not there. I wasn't there to experience it firsthand. But it's some background on Gil because his background actually provides some good context on the firm overall.

Gil is also an American, but he happens to be based in London. He spent a lot of his professional career in Israel investing, as a VC in Tel Aviv. He did that for 10 plus years and then was recruited by Index Ventures to come over to London and work kind of scaling up their seed programme across Europe.

He kind of saw that there was a lot of similarities to the way that folks invest in Israel, and that style of investing could be brought across to the rest of the UK and Europe. A lot of that style of investing for what it's worth is, looking at companies that are deeply technical and thinking about go to market from a decidedly US centric point of view, more so a global point of view.

And, you see this in Israel, it's quite obvious, because if you build a company in Israel, your market is not going to be Israel. It's too small for that to be your only market. So you're building globally from day one. You're always thinking about other markets that you're building for. And that same approach makes a lot of sense across any enterprise B2B company because 50 plus percent of all enterprise spend globally comes from the US. That market just matters and it's homogenous too. So if you're able to nail it, then you have half of global revenue that you could probably, acquire is in that one market, so it's worth looking after.

Gil kind of took that idea, from that angle and said, "You know, I think that we can be sector specialists, be really focused on B2B and enterprise deeply technical founders, but geographically much more broad." So we don't need to be sector specialists or super sector specialists, super geographic specialists. Like, some other firms they only invest in Israeli companies, or they only invest in UK companies, or they only invest in AR VR companies or something like that. And, we felt like this balance of saying we can invest in all enterprise and B2B because they're actually quite similar. There's lots of ways that these companies the same to go to market motions are similar, all of that, but we can invest across the entire region. That might be a really interesting angle.

So that's the kind of a somewhat bastardised version of his original, kind of pitch that he was giving back in 2014, 2015, when he was raising that initial funds. And the first fund he's had, amazing success with it. There are some really great companies that have already started breaking out. You can go to the website and see, but there's some amazing ones kind of across the board.

So he raised on the second Fund, which is now about double the size and $80 million fund just a few months ago. I joined kind of a long side with that fund.

Why join Angular? And this is a question I thought a lot about because I wasn't sure exactly what I wanted to do. I left Airtable, and I knew that I wanted to get back to early stage like that is what had pushed me to leave because at this time Airtable was over 100 million in ARR. It was over 600 people. There are lots of interesting challenges, but they're all big company challenges and I was just less excited about those.

So I knew I wanted to get back to early stage, but I didn't know exactly how, I wanted to do that and what that was gonna look like and so I talked with a lot of founders and I talk to the wild, big multi stage VC firms, and then I was talking with Gil at Angular. And, ultimately, I was really convinced by the idea of joining Angular for a few reasons.

One is that, Angular itself is an emerging fund. There's a lot of building to be done. We're trying to build our brand, we're trying to build this business. If I'm gonna do investing, at least I want to do like the most entrepreneurial version of investing which requires us to build stuff. I'm also trying to figure out what our office space should look like and what I was putting on my desk on the first day, I'm doing all that stuff too. That's the stuff that I love.

And the other thing is, Angular is truly early stage. We really invest, we try to be the first check firm. That really resonates with me a lot like that type of investing. And we'll also kind of low volume, high conviction investors, we make five or six investments per year and that's it. And I'm really like, deeply partnering with you when that is all we focus on. And that's kind of the version of investing that just resonates with the most. As early as you can, low volume, super high conviction - it's the type of investing that speaks to me. So that's kind of a quick background on Angular and why I chose it.

Q: And when you're talking about the high conviction, your team has written many different articles about what you believe in the enterprise and deep tech topics. Can you just elaborate a little bit about what kind of enterprise and deep tech companies you're looking for, and why?

A better way to describe what we're looking for is to describe what we are not looking at. We do not look at anything is anything that's super consumer drive, or if it's technical in ways that we can't really diligence quickly, for example biomedical or pharma which just isn't an area of expertise for us. But if they're if it's anything within the realm of B2B, if you're selling to a sophisticated buyer, then we're on board to understand it.

I think that's still quite abroad and we kind of do that on purpose. A lesson that I learned from working at Founder Collective: when you're an early stage investor if you try to be too thesis driven, you can get yourself in trouble. Let's be honest, you're not being paid to invent the future, invent what is going to matter 5, 10 years from now. That's what the entrepreneurs are doing. Entrepreneurs are the ones who are inventing the future. You're paid to try to find those people and support them and to invest in their companies.

One way to visualize this is if you go into Google Trends search, and you search for some of the classic trends of the 2010s: maybe like car sharing, or something. If you look at when car sharing peaked, so when probably every VC out there was like this is a trend that I want to invest in this - car sharing. But if we look at when it peaked, Uber and Lyft have both been founded like five years prior.

The companies that are going to make outsized returns and change the paradigms, they always look completely insane when they're started. So as an early stage investor, I try to keep that in the back of my mind always, which is like we're looking for some secret insight about the world. We're looking for somebody who believe in something that nobody else believes.

We're not looking for something that just reinforces a thesis we have. We're not the entrepreneur, we're not the inventor, so we're probably wrong. We're probably three years off, at least. So that doesn't give you a specific thesis to pitch me on I fully recognise, but that's kind of the point. I rather just hear your secret the secret insight you have about the world.

Q: Just following on from the point you just made like how if you're looking for people that are, I guess thinking of it differently to your knowledge not necessarily fitting your own mindset, but are maybe visionaries in other ways? What criteria are you using to actually select them whether you see them as a good investment or not?

It's a good question. Look, I think that there are questions we always try to ask each other. When I say each other, I mean, Gil, my partner Gil and I, that we tried to push each other on.

Let me sit back and say there's a few things that matter. I think, one thing that matters a lot, especially early stages. It's useful to remember this as a it's a people business, ultimately, like you're signing up to work with these people for the next 10 years of your life. Let's say if everything goes well. So you know, I do think that really matters.

The companies and vendors that I speak with, often ask what our investment process is, and I say, it's just me and my partner, there's no investment committee. There's no bureaucracy, we can move quickly. But also, I want to get to know you and I hope that you want to get to know me. I think actually that process is just really important.

I think having a personal fit is necessary but not sufficient condition for working together. The other thing my partner Gil and I will ask

- What type of risk do we feel this business is taking? Is there some technical risk here and if we are not sure if this technically is going to work, or is there some sort of market risk we do not know.

- If there's a real market opportunity here?

- Is there some team risk? If these are the right people.

We'll try to think through really carefully which of these, what the risks are. Then we just try to question

- Do we actually believe that? Is that a risk worth taking?

- Do we think we can price it and feel comfortable with it?

Because ultimately, every investment that I get really excited about it's always one where it seems like the founders believe in something that nobody else believes. But somehow they've convinced me of it too, and now I'm starting to believe it.And that's what's really exciting because then you start feeling like okay, we're in this together.

We both believe this crazy thing that nobody else believes. How can we convince the next round of investors? How can we convince them, that actually what we both believe is true? So ultimately, I think that that's the feeling I want to get with the founders that I work with, is that we're kind of in the corner together and taking on the world.

Q: Super exciting. And maybe one of the challenges for early founders that they often, they might not have find the product market fit yet. And they're still exploring different user case in the market verticals. You actually read in the article about how childhood would affect the entrepreneurship. We talked about exploitation and the exhilaration what kind of advice you offer to founders when they're at that stage. And also what kind of growth do you expect from founders within six to 12 months after you make an investment?

Yeah, so good question. What do you expect post investment? I think that, there's no one size fits all answer to that. I think it completely depends on the specific company and what hypotheses you need to prove. What are the key assumptions or key questions that you need to answer to de-risk about the company.

So it's hard for me to say these are the specific metrics of growth that matter, because I don't think there is an answer like that. Instead, what I would say is, at high level, what matters is, after you raise money, it's a really good time to step back and say, Okay, what must be true?

When we go out and raise our next round of financing, what must be true when we go do that? What must we have proven for it to be a really successful financing and agree on that. Figure out what those things are.

What are the proof points? And what are the KPIs from the evidence from it to those proof points? Figure out what those are, aligned on those and then execute.

I think what you'll find is especially early on, you get a lot of credit from learning. So maybe you haven't figured it all out. You probably won't in six to 12 months, you won't have perfect product market fit at that point. But if you can show how much you've learned, how much you've shipped, like you've shipped a lot of product, you've learned a lot of stuff, in that time and that you're kind of executing really well. Then I think you'd get a lot of credit for that sort of work really early on.

I forget who the investor said this, they talked about how entrepreneurship is like turning over cards, and you're trying to find the answers. All the answers to all these questions turning over cards; And investors want to see the answers on the other side of the cards. That's all they care about. Your job as a founder is to figure out what is the right order to flip over the cards, what's the right order to answer the questions, so you can kind of construct a story. You're finding your way through the maze to build this business.

Q: I think one other thing that the other founders here are very interested in is growth. And when you started at air table, you mentioned it was one of the most weak and the scariest job title you got yourself into. So what kind of advice would you like to offer to early stage founders here today? Who are building their growth strategies?

I think one of the challenges with building growth teams early on is you don't necessarily know what channels matter. You don't know what tactics are going to be useful or important to you as a company.

It can be scary to go hire some specialist. If you go hire a growth marketer or a content person, or whatever it is, what do you do if your growth marketing doesn't matter at all for your business, or if content is not important.

There's a really tough in between phase, which I often find, where a company is kind of grown up. The founder, the CEO is basically the head of growth. They're the ones who are doing everything, and then they get to a point where they can't do it anymore. They need some help. They need to that part of the brain and give it to somebody else. But they don't know what to focus on. And it doesn't make sense to hire that specialist. So they're trying to like fill that gap. And that was kind of the role that I was hired for Airtable. It's like this growth generalist. Basically, it's like, you have experience across all this stuff. You can just kind of help us figure out what matters and then hire your backfill, like me being successful was spinning up growth marketing strategy, and then hiring somebody to do it 10 times better than I did.

So you want to find somebody that has that mentality that's willing to give away their "Legos". They don't want to build a fiefdom right there. Their goal is to leave with fewer responsibilities than they came with.

So that's often my advice. Once you're getting to the point where you as a founder is kind of overwhelmed, then trying to find somebody like that, who can kind of be your experimenter and chief and figure out what channels matter.

Unless of course, you already have proven out like and you know that this channel matters to you and then you can double down on it.

Q: And I have one more question. Actually, your most recent article you talked about, like stay focused is an advice founders often hear, but you wrote about building a compound startup might be the next great non obvious SaaS play. And the arguing stay focused view might be outdated. So can you tell us a little bit about that?

This was kind of inspired by this talk that the CEO of Rippling Parker Conrad gave at a Startup Grind event a few months ago. I watched this video and it's like criminally under watch. And it was so interesting. So I figured I would write a blog post about it. I would totally recommend watching that. If you search for compound startup, I think you'll find it. I totally recommend watching it

But basically his premise, which I've noticed this as well and really resonated with me is that: I have a friend who's actually one of the early salesperson at airtable was now starting as the VP of sales at another company and he's figuring out what tools he wants to buy for this sales team.

He's buying like a laundry list of tools. It's crazy how many different things he's bringing on board to the point where he did the math and now like the cost per rep is going to be $300 $400 per month (just for sales related SaaS tools). And, you know, that just seems kind of crazy, right?

Has the pendulum swung, such that we were just so over tools and there's so many pieces of software, so many wedges, increasingly narrower wedges of the market. Is the pendulum gonna start to swing back towards product portfolio type companies? Of course, people remember the reason we got here is because those big product portfolio companies like bad; a lot of the modules were terrible, and that market share was stolen by point solutions. So this is a pendulum that swings back and forth.

But the premise of the article is questioning: maybe the pendulum is a little bit too far in this direction, and it's going to start swinging back. And I wonder if this resonates with the founders in the audience, I feel like you often see this when you're trying to sell in. You've built some SaaS tool that you're trying to sell, sell into an org and a company.

I remember this happened at airtable. We talked to some of our customers, they would hire a new CIO or something like that. And the CIO would say, Okay, we need to cut 30% of our subscriptions. And it was somewhat indiscriminate. It was just like, there is no way we should be spending this much money on random SaaS tools. Cut 30%, I don't care what we cut, we just need to cut 30%. I feel like you're seeing this a lot where it's just really hard to sell into an org that just feels so over- tooled and over-bought.

So anyway, that was kind of the high level premise of this blog post I wrote. And the kind of question I was posing is like, maybe there's actually an opportunity now to build a next generation of these product portfolio compounds, startup type companies where the premise the approach from the beginning, is not to build a super point solution, Uber focused SaaS product;

But the goal is actually to own a foundational data layer to own a whole business process - to do the hard thing. We're not going to do the narrow thing. We're going to do the big, wide hard thing, but we think what we benefit from, we're going to lack focus, but what we will benefit from is a superior customer experience- Because we're centralizing that you don't need to deal with, connecting all these different point solutions and all of this instead, you'll get the same data will be accessible across every product in the portfolio. It's seamless, it's easy, that's the premise.

I'll be honest, I don't know if that's right. I think it's an interesting thought experiment, at the very least.