I was fortunate to attend the SuperReturn conference in Berlin at the end of Feb 2020. The 4-day conference is a great place to learn from LPs and GPs about private equity, venture capital, private debt, and real assets.

In one morning session, the reporter Miriam Gottfried from The Wall Street Journal was interviewing Stephen A. Schwarzman, and the main conference room was fully packed. He talked about his entrepreneurial journey and shared his perspective on investing in real estate.

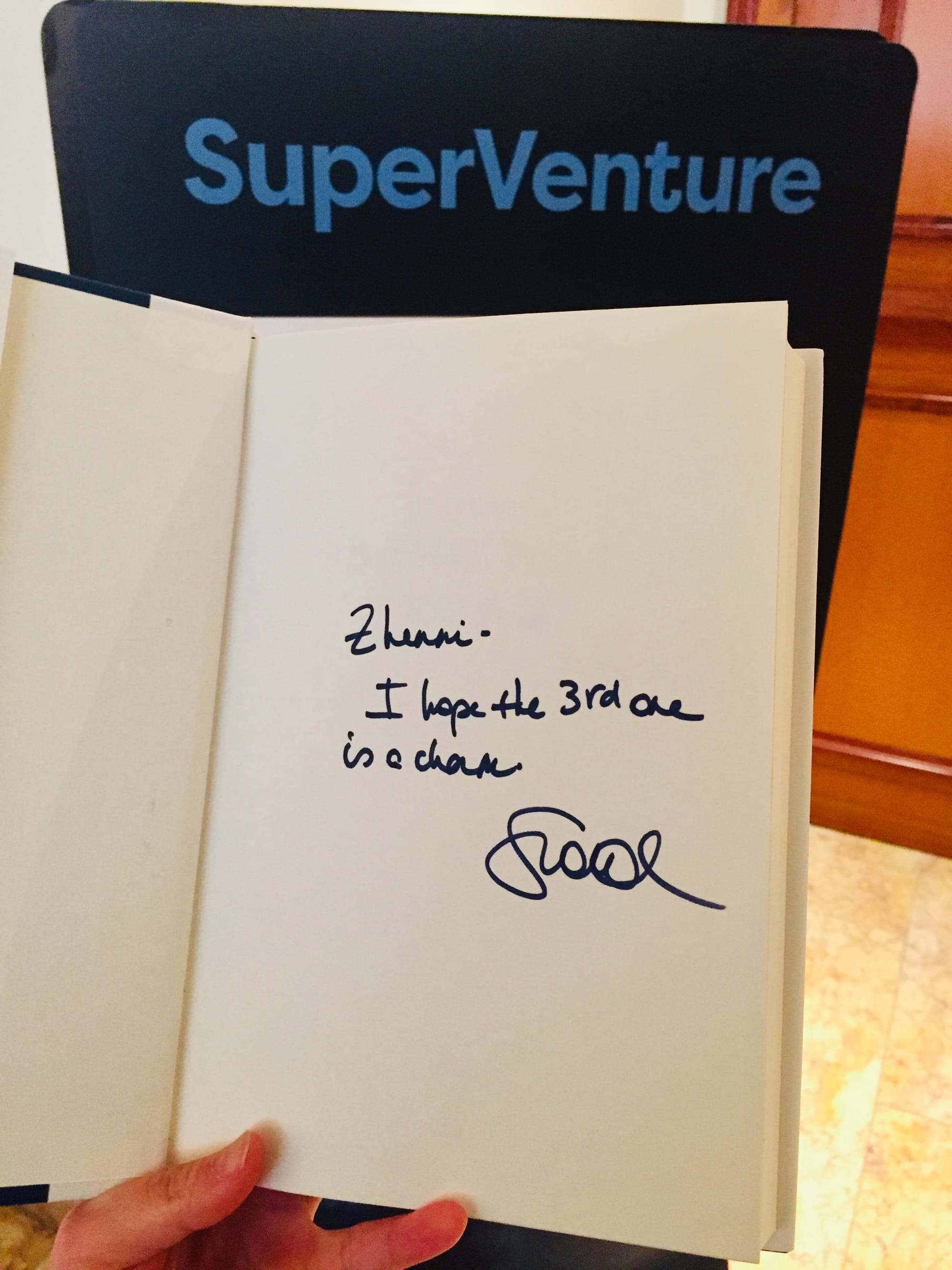

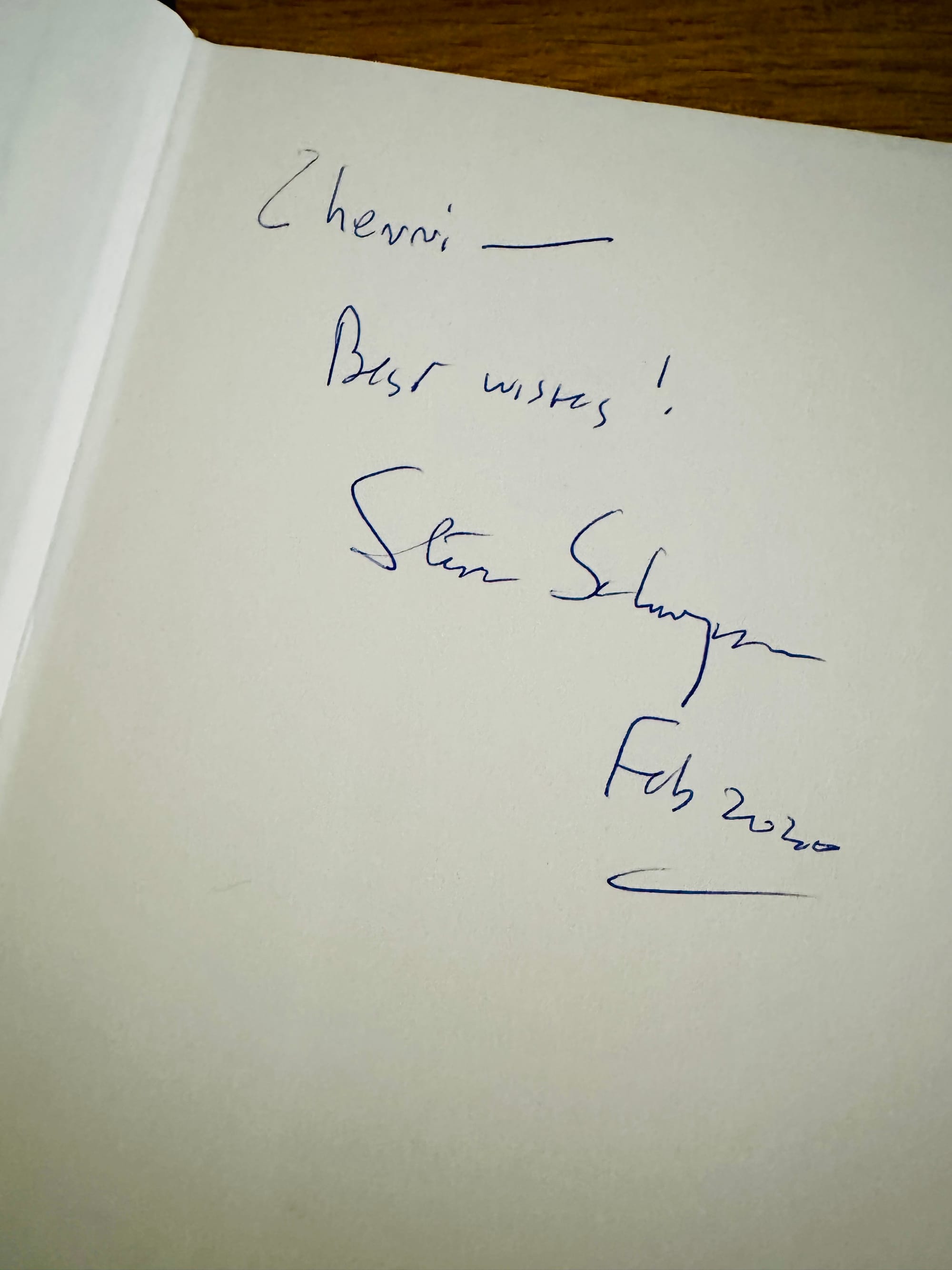

They offered his books for free in the conference hall and I immediately went to grab a copy. How could I miss the opportunity to get the book signed by him?

I was so excited that I got my books signed by Scott Kupor and Stephen Schwarzman in 2020

During the Easter holiday, I finished his book and I recommend anyone interested in private equity and entrepreneurship to read it. He has summarized 25 golden rules of succeeding in life and work and you can read and buy his book here. Below are a few of the business advice from the book which I found quite helpful and I hope it will be useful to you as well!

On Entrepreneurship

Entrepreneurship is hard. It is better to be a fantastic thing that you are spending your life on because you have to work hard, whether it’s a small, medium, or big size opportunity — they are all difficult. Therefore, he suggested that we should aim for the right business opportunity that has a big enough market size so that we can achieve bigger success.

"I’d often go and sit on a bench in the courtyard of Branford College, the prettiest college at Yale, where I could listen to the carillon of Harkness Tower, and think, What could I do that would get the whole undergraduate body excited? Something inventive? One of my more unusual achievements had been to set the university’s vertical jump record, forty-two inches, during the physical exam we took when we arrived. But I know there was more I could do, and my experience at Abington with Little Anthony had taught me a lesson I have replicated throughout my life: if you are going to commit yourself to something, it is easy to do something big as it is to do something small. Both will consume your time and energy, so make sure your fantasy is worthy of your pursuit, with rewards commensurate to your effort"

Besides the market size, he also talked about solving a real problem, differentiating yourself from others, and staying curious. A few quotes that I quite enjoy:

"Watkins had a difficult problem, and he wanted an inventive solution. As an investment banker and later as an investor, I found that the harder the problem, the more limited the competition. If something’s easy, there will always be plenty of people willing to help solve it. But find a real mess, and there is no one around. If you can clean it up, you will find yourself in a rare company. People with tough problems will seek you out and pay you handsomely to solve them. You will earn a reputation for doing what others can not. For a pair of entrepreneurs trying to break through, solving hard problems was going to be the best way of providing ourselves. " — Page 109

"If you are going to start a business, I told them, I believe it has to pass three basic tests. First, your idea has to be big enough to justify devoting your life to it. Make sure it has the potential to be huge. Second, it should be unique. When people see what you are offering, they should say to themselves, “My gosh, I need this. I’ve been waiting for this. This really appeals to me.” Without that “aha!” you are wasting your time. Third, your timing must be right. The world actually doesn’t like pioneers, so if you are too early, your risk of failure is high. The market you are targeting should be lifting off with enough momentum to help make you successful. "— Page 199

"The third and final way we thought about building our business was to keep challenging ourselves with an open-ended question: Why not? If we came across the right person to scale a business in a great investment class, why not? If we could apply our strengths, our network, and our resources to make that business a success, why not? Other firms, we felt, defined themselves too narrowly, limiting their ability to innovate. They were advisory firms, or investment firms, or credit firms, or real estate firms. Yet they were all pursuing financial opportunity. "— Page 99

"But one of the great things about the entrepreneurial experience is that over time, if everything works out, life does get easier. As your business matures, the quality of the people around you gets better and your systems become more consistent. You put the right risk controls in place. You create an institution with successors who care. Your reputation improves and starts doing some of the work for you. The virtuous cycle spins faster, and in the case of Blackstone, clients and investors give us more money in larger amounts than they ever did before. " — Page 283

On Investing

"When I began my career, I was like most other ambitious young people: I believe success was achieved in a straight line. As a baby boomer, I had grown up seeing only growth and opportunity. Success seemed a given. But working through the economic ups and downs of the 1970s and early 1980s, I had come to understand that success is about taking advantage of those rare moments of opportunity that you can’t predict but come to you provided you are alert and open to major changes. " — Page 113

"All my life, I have been looking and listening for patterns. It is like the old TV show, Name that Tune. The more songs you know, the more likely you are to be able to identify the songs from just one or two notes. You become like an experienced clinician, who can tell what’s wrong with a patient long before seeing the results of all the tests. The suspicious raised by that real estate meeting earlier in the week now grew into outright fears of an imminent collapse. As I sat there in the Florida sunshine, I began to have serious concerns about the risk of a global collapse. "— Page 205

"The key to all investing is using every tool at your disposal. I liked the idea of leveraged buyouts because they seemed to offer more tools than any other form of investment. First, you looked for the right asset to buy. You did your diligence by signing nondisclosure agreements with the owners and getting access to more detailed information about what you were buying. You worked with investment bankers to create a capital structure that gave you the financial flexibility to invest and survive if economic circumstances turned against you. You put inexperienced operators you trusted to improve whatever you bought. And if all went well, the debt you put in place enhanced the rate of return on the value of your equity when the time came to sell. " — Page 94

"Here are my simple rules for identifying market tops and bottoms:

- Market tops are relatively easy to recognize. Buyers generally become overconfident and almost always believe “this time is different,” It’s usually not.

- There is always a surplus of relatively cheap debt capital to finance acquisitions and investments in a hot market. In some cases, lenders won’t even charge cash interest, and they often relax or suspend typical loan restrictions as well. Leverage levels escalate compared to historical averages, with borrowing sometimes reaching as high as ten times or more compared to equity. Buyers will start accepting overoptimistic accounting adjustments and financial forecasts to justify taking on high levels of debt. Unfortunately most of these forecasts tend not be materialize once the economy starts decelerating or declining.

- Another indicator that a market is peaking is the number of people you know who start getting rich. The number of investors claiming outperformance grows with the market. Loose credit conditions and a rising tide can make it easy for individuals without any particular strategy or process to make money “accidentally.” But making money in strong markets can be short-lived. Smart investors perform well through a combination of self-discipline and sound risk assessment, even when market conditions reverse. " — Page 143

"While most investors say they are interested in making money, they are actually interested in psychological comfort. They would rather be part of the herd, even when the herd is losing money, than make the hard decisions that yield the greatest rewards. Doing what everyone else is doing seems like a way to avoid blame. These investors tend not to invest aggressively near market bottoms, but instead do it at market tops, where it makes little sense. They like the comfort and reassurance of watching assets go up. The higher prices go, the more investors convince themselves that they will continue appreciating. This same phenomenon explains why it’s almost impossible to bring an IPO to market near the bottom of a cycle. But as a cycle grows riper, the number, size and valuations of IPOs explode." — Page 145

On Fundraising and Failure

"Regardless of how you begin your careers, it is important to realize that your life will not necessarily move in a straight line. You have to recognize that the world is an unpredictable place. Sometimes even gifted people such as yourselves will get knocked back on their heels. It is inevitable that you will confront many difficulties and hardships during your lives. When you face setbacks, you have to dig down and move yourself forward. The resilience you exhibit in the face of adversity — rather than the adversity itself — will be what defines you as a person."

" We wrote nearly two thousand letters over five years, tailored to each potential donor, explaining why this would be a fantastic use of their money. If they showed the slightest interest, more letters and more discussions followed. I kept those who turned me down on our mailing list. When Mike Bloomberg gave me a check, he said he did it out of the fear that I would never stop asking." — Page 294

"Next, we headed to Saudi Arabia. After five days of doing six presentations a day, we didn’t have a single commitment. Exhausted, on our last day in Dhahran, floating around in the hotel pool, I started telling Ken how successful we would be. I laid it all out for him. To be successful you have to put yourself in situations and places you have no right being in. You shake your head and learn from your own stupidity. But through sheer will, you wear the world down, and it gives you want. The money had to be out there. It told him to forget about what had just transpired in Saudi Arabia. It was done. Wasted. We were going to be successful, enormously so. " — Page 132

"He asked me to sit down and started screaming at me. Was I a complete incompetent or just stupid? What kind of imbecile would squander his money on something so worthless? How could he have given a dime to someone as inept as I was? As I sat there absorbing the punishment, I knew that he was right. We were losing their money because our analysis was flawed……I felt tears welling up and my face turning red and hot. I had to force myself not to cry. I said I understood, and we would do better in the future. As I found my way to the parking lot, I vowed to myself, This is never, ever going to happen to me again. "— Page 148

On Management

"We structure our investment process to democratize decision making and encouraging intellectual engagement by everybody involved — the deal team and committee members. There is no “us” and “them”, no seeking of approval from a group of elders. Instead, there is only a collective sense of responsibility for identifying the critical drivers of a deal and analyzing the extent to which those drivers could affect the financial performance of an investment in various scenarios. "— Page 158

"To be a good manager requires being emotionally open and direct about everything, good and bad. When we are thinking about our next class of partners at Blackstone, I interview everyone being considered and we talk about what they have achieved, how we feel about it and we ask each other questions. Once the decisions are made, I call everyone who has been made partner, and those who haven’t. I tell each of them how I feel about them — about their abilities, their potential, and what I think we can build together at Blackstone. That openness creates cohesion in the business. I can’t imagine building an organization any other way. " — Page 335

On Passion

"Devote your time and energy to the things you enjoy. Excellence follows enthusiasm, and doing anything solely for prestige rarely leads to success. If you have passion for pursuing your dream; if you persevere; and if you are committed to helping others, you will have a full and consequential life and always have a chance at greatness. And the benefit of your enormous gifts will accrue to yourself, the people you love, and to society at large. "— Page 348