Stepping foot in Tokyo for the first time was an overwhelming experience for me. The bustling streets, vibrant culture, and cutting-edge technology make Japan an exciting destination for business travel. As I represented Helsinki Business Hub, my purpose was to explore Japan's tech ecosystem and attend the Global Venture Capital event to attract Japanese investors to Finland and meet potential partners.

Attending the Global Venture Capital event was the highlight of my trip. It provided an invaluable opportunity to immerse myself in Japan's investment community. The event brought together a diverse group of entrepreneurs, investors, and industry leaders, all eager to explore potential collaborations and partnerships.

About GCV Asia

GCV Asia Congress is the international conference for VC and CVC with a strong interest in investing in startups in Asian countries, gathering to discuss investment trends and hot startups in each country. The event is hosted by Mawsonia, UK based media company for news reports on the investment trends of VCs and CVCs around the world. In 2019, CV Asia Congress was held in Tokyo on Oct 1st and 2nd. About 60 VCs and CVCs from the US, China, Hong Kong, Thailand and other countries will participate.

Incubation & Innovation Initiative (III) Consortium, private-led open innovation platform in Japan, and Global Corporate Venturing (CV) Asia Congress, jointly organized this special event to discuss smart-city related topics. In this event, the current situation of smart city development in Japan, its uniqueness, issues faced, as well as trends in startups that are involved in smart-city projects in Japan and overseas are to be discussed.

AW with my team in Tokyo (left); My colleague was introducing Finnish startup ecosystem (right)

Smart City Japan

During the event, our main focus was on designing our society in the Reiwa era. We took the opportunity to share insights into Japan's smart city development with overseas venture capitalists (VCs) and corporate venture capitalists (CVCs). We explored various aspects, such as similarities and differences in overseas smart city development approaches, public-private partnerships, and trends in both domestic and international startups related to smart cities.

Also, I watched the following interesting startups pitching:

While LiDAR as the main sensor to capture point clouds and those sensors cost more than USD 50,000, the Perceptln sensors cost only a bit more USD 1,000.

"Their vision is to supply safe electricity to all human beings through the innovation in wind energy. Their Magnus vertical Axis wind turbine enables to harness energy from strong wind and turbulence as tropical storms safely"

"TrueBizon has established a protocol and system that enables the safe and widespread use of low-altitude aerial vehicles including drones and air taxis. The company's sora:share protocol is emerging as a de-facto standard for Japan, and its system of applications, permits and waypoints is presently in use to enable safer drone flights in Kyushu and the Tokyo area. The system is generating revenues for the owners of the system, owners of airspaces, and insurers. The sora share protocol and the enabling system is patented in Japan and the company has applied for a worldwide patent."

"We eliminate congestion and long lines from the world by gathering all manner of vacant seat information. " Their services & benefits:

- Real-time visualization of restaurants or lavatories' availability using loT devices and Artificial Intelligence technology improves the user experience

- Digital signage make it possible to deliver information to all sorts of people from child to the elderly who don't really use smartphone, and tourists, using internationalization

- The digital signage updates in real time to reflect the current level of congestion

automatically issue coupon according to congestion condition (only for smartphones)

Founded in August 2018, Bitkey is a company specializing in smart lock solutions and the BKP digital key platform. Within just eight months of development, both products were launched in April 2019. Impressively, Bitkey received over 60,000 unit orders within five months after releasing its first smart lock, with a projected sale of 200,000 units for 2019 alone.

Compared to other well-established smart lock companies operating since around 2015, Bitkey's bestselling smart lock achieved 60,000 units sold in just four years. In contrast, Bitkey achieved this milestone at a remarkable ten times the speed.

Incubation & Innovation Initiative (III)

I learned about III and was impressed by its vision to build an innovative ecosystem that creates both social and economic values. It builds a new platform of open innovation by cross-alliance of the industries and develops a "networked strategy for business development" that fully utilises our assets in all industries.

- It develops an incubation/acceleration program "MIRAI" for startups at seed and early stage that have high potentials to bring social impact to accelerate their business growth.

- It leads collaboration among variety of actors such as III consortium members, startups, research institutions, and financial to conduct joint research studies and business development projects.

- Based on various case studies of legal and industrial systems, III makes policy recommendation and suggests pilot projects under public-private partnerships to develop necessary legal system that boosts up innovation that fit social and economical reality.

Visit Sony Corporation and Sony Innovation Fund

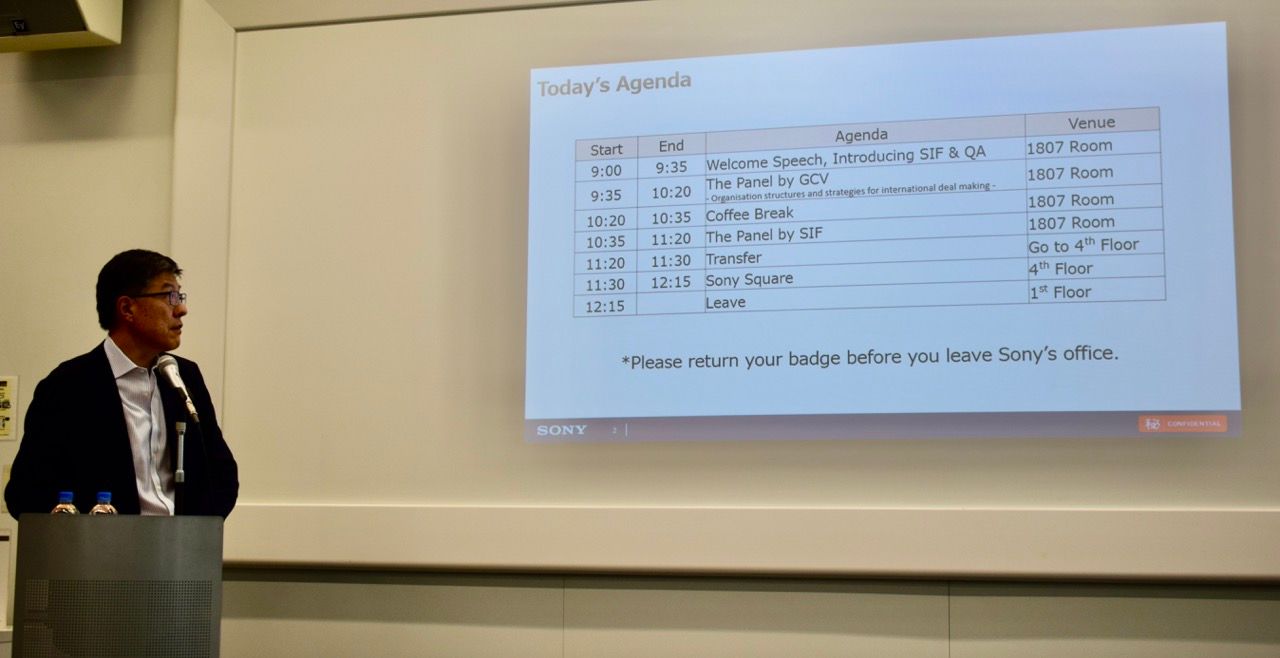

We were received by Gen Tsuchikawa and his team. He is the Corporate Vice President at Sony Corp, Chief Investment Officer at Sony Innovation Fund, and CEO at Innovation Growth Ventures, a Japan-based joint venture by consumer electronics producer Sony and brokerage Daiwa Securities. During his career at Sony, he has served as head of investor relations, head of mergers and acquisitions and head of business development. It was interesting to listen to his experiences.

Gen was presenting the agenda 2019

Some takeaways from this presentation:

- Fund size USD 100 m (ticket size MAX USD 3M) with track record of 50 investment as of 2018 July and focue on early stage from seed to series A

- Non-control preference with board observation/participation with Co-lead or follow preference, but can also lead investments

- The geography is in the US, EU, Israel, and Japan and the investment focus area has been expanding from Robotics & AI to Drone, Logistics, Life Science, Sensor, AR/VR, Service, Mobility, Music, Gaming, Fintech, Blockchain, DeepTech, Industrial IoT, Sports and Food.

The next step for Sony Innovation Fund (SIF)'s futher evolution is to set up structure to invest in larger rounds and create an investment structure resilient even in case of economic recession. The team aims to create a new fund for middle & late stage investments + rally external LPs + fully leverage on existing SIF operations. It'll will ensure transparent governance & decision-making through 50:50 GP structure between Sony Group and Daiwa Securities Group.

I really enjoyed the engaging discussion with all participants

Corporate Venturing Japan 2019 Q4

GCV has published quite extensive research on this topic and I recommend you download the report below:

Here are some takeaways from the report:

- Japanese VC investments as a proportion of GDP remains half that of France, a third compared with Canada, a seventh compared with China and a ninth of that in the US.

- Japanese startup funding has registered a major increase in recent years. Venture capital investors currently account for about a third of the total investment in the country while 50% comes from corporate investors and their subsidiaries according to Japanese Venture Capital Association.

- Japan-based venture capital investors and corporates do not tend to focus on SaaS as it is still en emerging market in the country according to Shinji Asada of Salesforce Ventures.

My short adventure in Tokyo's startup and venture ecosystem was nothing short of transformative. The city's dynamic energy, technological prowess, and deep-rooted cultural values left a mark on me.

I spent a few days visiting different parts of Tokyo 2019