Let's build a future where people in positions of power will invest, hire, and mentor more founders, talents, and students from diverse backgrounds.

For seven years now, MINC has been hosting the Nordic Fe: Male Invest Summit to gather female founders and investors to inspire, lead, and innovate. On the 12th of October, at Malmo Town Hall, the Skåne community focuses on creating opportunities and encouraging more people into the startup world. Below are some key learnings from the conference.

Changemakers Journey

Siduri Poli is a serial entrepreneur, investor, and author. Siduri is the co-founder and Head of Business & Brand of Changers Hub, an important entrepreneur hub. The project aims to democratize success and enable young people in marginalized areas to succeed with their start-up ideas.

She believes that innovation and new technologies must be linked to democracy and inclusion for our society to move forward. Now Siduri is investing and advising multiple companies and initiatives within tech, branding, and social change.

As an investor, Siduri pays attention to the meaningful human moments that companies can create for their customers. “The moments when the idea changes and gives extra value to someone else’s lives,” she says.

She believes in the value of ideas and founders with diverse backgrounds and situations. She said that we tend to invest in people who look or think like us, however, it is important to reduce bias and offer opportunities for minorities to succeed.

Unconventional fundraising

Miriam Olsson Jeffery, a business reporter from HD-Sydsvenskan. With experience from working as a business and tech journalist both in Sweden and in Silicon Valley, where Miriam was a correspondent for Svenska Dagbladet, Dagens Industri, and IDG, she has a deep understanding of the tech world. She has for many years put effort into covering equality, diversity, and inclusion in tech, and is a co-organizer and moderator of the Female Founders event at Di Digital/Dagens Industri. She hosted this insightful discussion with Thea Messel, the General Partner of Unconventional Ventures.

They noticed that many great ideas, entrepreneurs, and solutions stay overlooked and unsupported. These ideas are not conforming, known, and expected by the traditional investment landscape.

Unconventional Ventures launched the first alternative investment fund. It required time and effort because of the legislation, but they were happy that the fund kept growing. However, female General Partners only led 15% of funds in Europe. Creating a VC fund is challenging, but she wanted to create something to help amazing founders.

Male investors sometimes ask hilarious questions such as “Can women in minorities build scalable companies?” She explains that the question itself is not mean. Many companies started by minorities remain small in most cases. She says there should be something more progressive and supportive in the system. It is crucial to invest in diverse founders because they perform very well. She urged LPs and GPs to support these companies built by diverse founders.

Democratize access to capital: Investing in diverse founders

In this open discussion, Carmen Beltran, Somit Fessehazion, and Christian Tooley shared perspectives and experiences about fundraising as minority founders. Tove Lilliestierna, an impact investor from Norrsken VC moderated the discussion. The Nordic countries are more egalitarian societies. Yet, it is still quite common that the minories have a more difficult time in building and growing their business.

Panelists agree that diversity is more than gender. Somit Fessehazion mentioned that ethnic minorities need more support sometimes. Ecosystem support organizations and different stakeholders should be aware of this.

Christian Tooley is listed as a Top LGBTQ+ Future Leader by Yahoo Finance, winner of McKinsey's Achievement Award, and is recognized as a Global Shaper at the World Economic Forum. It is key to ensure diversity in the decision-making group (i.e. board members, the investment committee). The panel shared the concept of Intersectionality. It means that one person can have multiple experiences from the intersection of systems of inequality based on gender, race, ethnicity, sexual orientation, gender identity, disability, class, and other forms of discrimination.

Tove Lilliestierna mentioned that investors should focus on the strength of the idea rather than ticking all the boxes. Carmen Beltran has built a financial wellness platform for women. She has a background in finance and business development with more than 12 years of experience building teams in different industries in Colombia, Sierra Leone, Switzerland, Thailand, The Netherlands, and Sweden. Passionate about adult education, financial inclusion, and diversity in tech. Board member of Emmstech- women of color in tech Nordics. She mentioned that men receive more funding than women to try and test though women started more businesses than men.

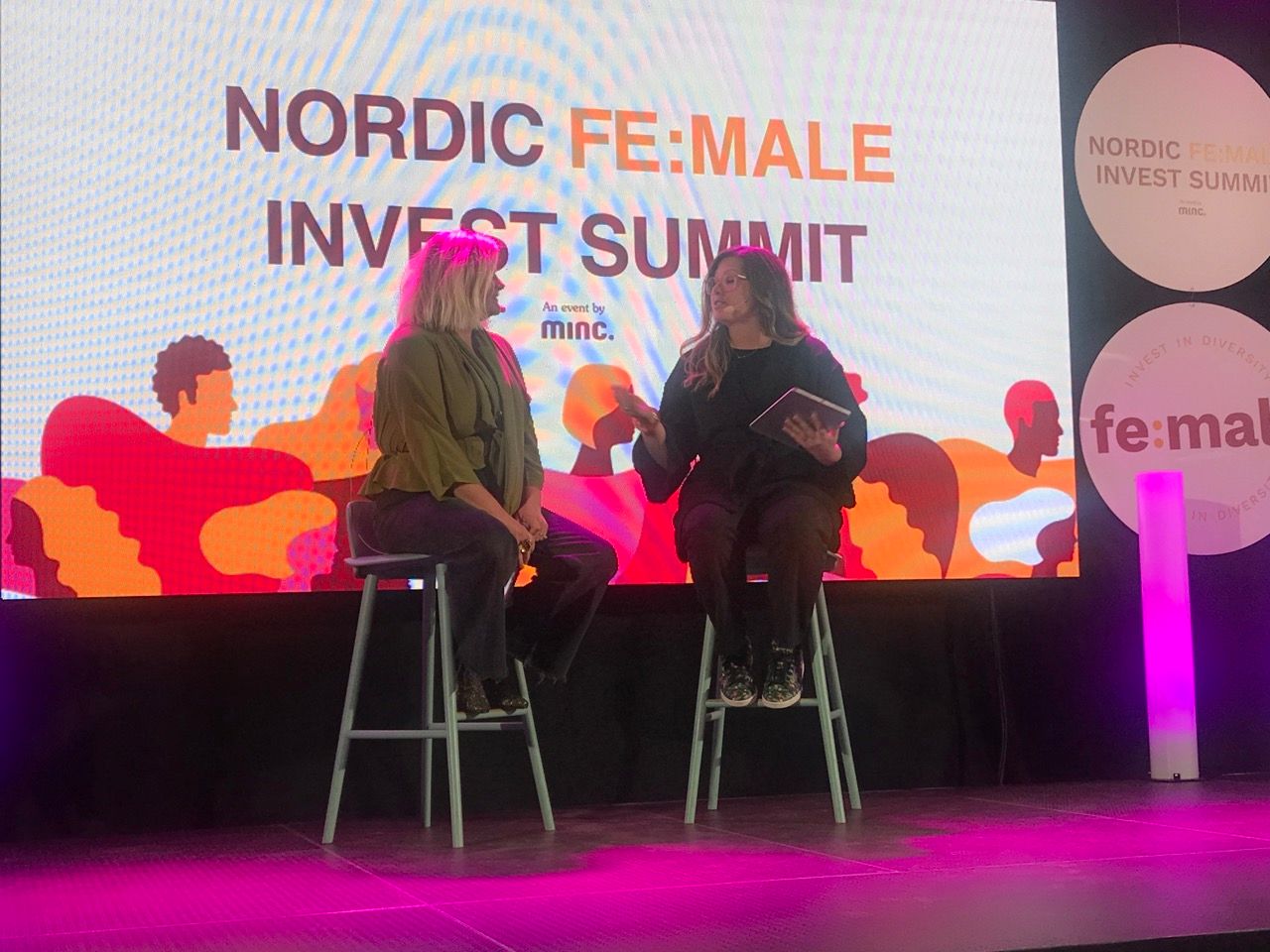

Dragonflies and Damselflies: Four Lessons in Gender Lens Investing

Lauri Robbins Ericson is an international speaker from the US. She is a consultant, advisor, and speaker with a focus on social impact and social innovation. Her work in Europe, West and South Africa, India, Central America, and the United States has magnified how important it is to transform the perception of females in society so their contributions are valued. Her TEDx talk, titled “Shifting Gender Paradigms: Speak Up, Stand Up, Rise Up” is now featured on TED.com.

She said that when it comes to raising capital, males consistently outperform females. What is worse, she mentioned, is that despite a lot of advocacy, we have not done much to change this. Sadly, obstacles remain unchanged in norms and attitudes. Some of these obstacles are not discussed or questioned. This leaves women undervalued. Women work more, earn less, and have fewer choices.

Even Sweden, a country that represents what is possible for gender equality, faces challenges in investing in female founders. We need to teach girls to raise their hands at school, ask questions, and stand up in front of the crowd, so they perceive themselves as smart and powerful. If we teach girls to do it, they will apply for jobs and will not wait until they are ready. They will negotiate better pay, take risks, invest, and start companies. Lori believes that the Nordics will lead in the future because of Nordic values such as the way of working, and the ideals of gender and inclusion.

Men as allies in the ecosystem

Heidi Lindvall, Sandra Wirström, and Sami Niemi discussed the importance of men as allies in the ecosystem. Heidi has a background in media and human rights. She has founded tech startups and spent time in London and Silicon Valley and more recently set up a startup accelerator in London before moving to Sweden to help run Fast Track Malmo. Sami is a Partner at Spintop Ventures, the leading Nordic early-stage tech VC. He has roots in mobile imaging technologies, having co-founded Scalado. The company grew to become a world-leading Mobile Imaging SW company, with more than 1 Billion licenses sold worldwide to essentially all the OEMs and many of the sensor/chipset makers.

Sandra is the Co-Founder & CPO of LEIA, the world's first postpartum tracker app. Mother of two with, Sandra started her career at Klarna and took her passion for user experience and women's health to Natural Cycles as the product owner. With the bad experience she had after both of her births, she took matters into her own hands and co-created LEIA. The world's first postpartum tracker app, through daily tracking, helps identify women at risk and gives them the tools they need to have a happier and healthier postpartum experience.

While there has been a generational shift in support and a perception of women, the annual startup reports and world policies do not seem to show major changes. According to Sami Niemi, men are still the main gatekeepers to access resources or power.

Panelists agreed that men have an important role in changing the situation.

Heidi Lindvall mentioned that companies should have general training and information to educate all members of the board about biases. However, it is not enough. They should proactively make an effort to include women or people who have diverse backgrounds.

In major startup communities like Silicon Valley, there are still ridiculous biases that affect women's access to resources, like the way a woman combs her hair during a meeting, attractiveness, and more. This trend also explains why minorities are less likely to be funded if there is a homogeneous view of the world from the board members, the General Partners, and the Limited Partners.

Nordic Fe: Male Invest Summit Panel Discussion in 2022