Finnish Business Angels Network (FiBAN) is a non-profit association of private investors. It has the largest and most active business angel network in Europe.

According to FiBAN, in 2019, startups and growth companies raised a new record amount, totaling 511 million euros. Business angels invested 54 million, a new all-time high, and Finnish venture capital (VC) funds invested 113 million euros.

So why should you join FiBAN network?

First, the FiBAN team offers practical training for new business angels, for example, the FiBAN academy is a great resource to learn about angel investing. They also invite their partners to offer workshops (only open to members) on different investment related topics.

Second, it also organises startup pitching events almost every 6 weeks - a great way to get access to deal flow. The events are well organized and there was a strong sense of community. I've participated in almost all of their pitching events and learned a lot from local founders and angel investors.

Most of the international investors in our network at Helsinki Business Hub are looking for more established companies with ticket size from 1-5 MEUR, therefore, we tend to serve relatively more mature Finnish startups. But I immediately saw the value of partnering up with FiBAN right after I joined the team.

The early-stage entrepreneur needs capital, but also mentorship and advice. The angel investors who have the expertise can guide those startups in entering into the market, improve the products/services, and future fundraising. (Here you can see the profiles of some active angels in Finland) Early-stage funding is risky, yet it is a critical part to build a strong and supportive startup ecosystem.

I initiated the partnership proposal and successfully convinced my team to jump on board. I was super excited and proud that we became FiBAN's partner starting from 2020. The blowed press release explained why it was important to work with FiBAN.

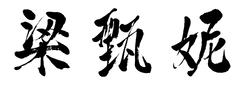

“Our service at Helsinki Business Hub is quite broad. For example, our team also helps international corporations to find the right business partners in Finland, and startups offer innovative solutions that larger corporations are looking for. We can match them with the right business partners abroad from Asia, Europe and North America,” describes Zhenni Liang, Venture Advisor at Helsinki Business Hub.

“It is crucial for our team to stay in close contact with the business angel community and be aware of new technologies and startups,” comments Liang. “We see angel investors as important partners who can share information about the progress of their portfolio companies, which might be interesting for international investors,” she continues.

FiBAN has its own startup screening process. Below you can find a list of Nordic and Baltic startups that selected to pitch at FiBAN events from April to June.

If you are looking for investment opportunities in Finland and find one of the following startups interesting, please feel free to reach out to me. I will be happy to introduce you to the founders or relevant angels for syndication.

B2B Enterprise Software

Sweetsbot combines realtime work wellbeing measurement and instant help & guidance to employee like no other platform.

Capital seeking (€): 50,000 - 100,000

Pre-money valuation (€): 500,000

SaaS-platform to integrate electric vehicle charging service with existing systems like billing, CRM, mobile pay.

Capital seeking (€): 350,000 - 450,000

Pre-money valuation (€): 1,600,000

Magic Add provides WINK to add scannability to premium consumer products to better inform and engage users.

Capital seeking (€): 600,000 or more

Pre-money valuation (€): 2,400,000

Bitwards offers digital platform for managing peoples access to various spaces and assets for multiple market areas.

Capital seeking (€): 200,000 - 500,000

Pre-money valuation (€): 5,000,000

Second Thought has a digital unique product identity solution to trace product by package for efficiency of supply chain.

Capital seeking (€): 500,000

Pre-money valuation (€): 5,000,000

Buenno helps chain companies in the retail and service sectors develop a customer experience through on-demand customer feedback.

Capital seeking (€): 150,000 - 350,000

Pre-money valuation (€): 1,050,000

Priff 's mission is to make the benefits of efficient autodynamic pricing available to everyone.

Capital seeking (€): 500,000

Pre-money valuation (€): 2,000,000

Arkkeo is a cloud-based loyalty platform that connects merchant rewarding schemes and consumers’ payment cards.

Capital seeking (€): 400,000 - 500,000

Pre-money valuation (€): 2,700,000

ATOBI is an employee engagement platform for retailers - all communication, training and goal tracking in ONE app.

Capital seeking (€): 100,000 - 600,000

Pre-money valuation (€): 3,480,000

Enable Banking helps the Fintech ecosystem to use hundreds of different Open Banking APIs with licensed SDK libraries.

Capital seeking (€): 200,000 to 300,000

Pre-money valuation (€): 2,000,000

Living Strategy® is a software platform to bridge the gap between strategy and action in businesses.

Capital seeking (€): 300,000 to 500,000

Pre-money valuation (€): 2,200,000

Adusso User Experience Monitoring

Adusso is providing EHR system optimization to help healthcare providers to improve productivity and patient safety

Capital seeking (€): 300,000 - 700,000

Pre-money valuation (€): 2,329,688

Deal Room is a networking platform to change event industry from renting square footage to selling meetings.

Capital seeking (€): 250000 - 500000

Pre-money valuation (€): 2 500 000

Flexible Field Service Management solution for managing tasks, processes and remote technicians

Capital seeking (€): 950,000

Pre-money valuation (€): 4,000,000

Doohlabs is an AI-powered advertising platform that monetizes in-store trade marketing and ad inventory.

Capital seeking (€): 150,000 to 200,000

Pre-money valuation (€): 4,500,000

B2C Platform/Service/Product

We offer help in planning and carrying out your home stair renovation easily and cost-effectively.

Capital seeking (€): 100,000 - 150,000

Pre-money valuation (€): 500,000

Astrid Wild is a Nordic direct-to-consumer outdoor fashion brand for women, by women.

Capital seeking (€): 300,000 or more

Pre-money valuation (€): 1,700,000

Flow Bake offers high quality baking mixes to help health conscious people create easily healthy & tasty bakes at home.

Capital seeking (€): 75,000 - 100,000

Pre-money valuation (€): 600,000

For the travellers and groups. Things that locals do. Doerz is a community, platform and SaaS model building the bridge between travellers and locals.

Capital seeking (€): 100, 000

Pre-money valuation (€): 1 ,250, 000

SoundLily is a fantastic and groundbreaking software for anyone who would like to enhance their musical skills.

Capital seeking (€): 500,000

Pre-money valuation (€): 2,000,000

Kjelp is an intelligent marketplace for buying and selling of household maintenance services.

Capital seeking (€): 300000 - 600000

Pre-money valuation (€): 3 000 000

Health Tech

Medicortex is developing a biomarker-based diagnostic kit for rapid diagnosis of Traumatic Brain Injury and concussions.

Capital seeking (€): 100,000 or 4,000,000

Pre-money valuation (€): 8,800,000